The Method Episode #11

We Need To Sleep More

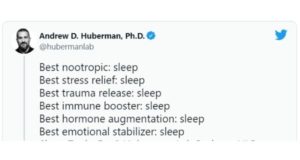

I’m veering off track with this one, but sleep is the most important thing you can do outside of your work that’ll help you perform.

Most of us don’t get enough. And we get even less than we think. Example = Me. I just got a new Oura ring. I thought I was getting 8 hours a night; it turns out I’m less than 7.

Our sleep requirements vary, but one thing is for sure we all have a minimum amount, and getting less than that is bad.

Dr. Andrew Huberman and our own Kale Panoho have many recommendations to help you sleep better.

I’ve taken a few of these tips on board and thought I’d share what has helped me get back up to 8 per night.

Get up at the same time every day

This was the hardest but most effective change. Set the alarm, no snoozing. Just get up. The earlier you set this alarm, the earlier you’ll fall asleep.

Get sunlight first thing in the morning.

Dr. Huberman recommends getting sunlight exposure in the first 60 minutes of being awake. I try to get mine in the first 15 minutes.

Take 150mg of elemental magnesium each night.

Elemental magnesium is different from total magnesium. Some bottles will only list total magnesium. For example, ‘magnesium amino acid chelate’ 160mg is only 32mg of elemental magnesium.

There are many different types of magnesium. Dr. Hubeman recommends Magnesium Threonate or Magnesium Bisglycinate. What I’ve found is the quantity matters more than the type.

No caffeine past 3 pm

When I break this rule, it takes me longer to fall asleep. I also make my afternoon (2.30 pm) coffee at half strength.

Don’t drink alcohol

I think we all know this. Drinking messes up your sleep. The less I drink and the less often I drink, the better I sleep.

Your Circle Of Influence Matters

You’re the average of the five people you spend the most time with.

I used to think this quote was BS. And maybe it is. But we are definitely influenced to some degree by the people we associate with.

It’s hard to see this in ourselves but easy to observe in others.

Take my Mum, for example. You could call her partner a natural-born salesman. He loves to exaggerate and tells every story with emotion.

My Mum used to be a straight shooter. Now she exaggerates often and tries to make every story an emotional one.

What’s the lesson here? Like some self-help types suggest, I don’t think it’s ‘bin your mates or your partner’. However, spending time around people doing or behaving like you want to do or behave is probably helpful.

Stanford Professor Jeffrey Pfeffer says, “You can’t be normal and expect abnormal returns”. In this context, which means finding people living outside the averages and getting their rub.

Before I brought my gym and lived with a personal trainer, I exercised haphazardly a couple of times a week and was a bit of a sloth. Now I exercise 7+ times a week and can’t go without it.

The point is the habits and behaviours of other people will rub off on you—both negatively and positively.

Like the best way to influence others is doing it first, yourself. Finding people who give off the right influence works.

The challenge is finding them. Rarely do these people just stroll into our lives. We’ve got to know what influence we want and seek it out.

“Planning is important, but the most important part of every plan is knowing life won’t go to plan.”

~ Morgan Housel

Wealthy Behavior

Getting wealthy is one thing, but staying wealthy is another. Believe it or not, these are mutually exclusive events.

Jesse Livermore and Abraham Germansky were successful and wealthy people by the late 1920s. Each had a net worth exceeding $100 million in today’s dollars. Jesse was a stock market trader, and Abraham was a real estate developer who turned to stocks.

When the markets crashed in October 1929, both were ~50 years old. So well seasoned individuals.

By the end of 1929, after predicting Black Monday, Tuesday and Thursday, Jesse was one of the world’s wealthiest people, making ~$3 billion. Abraham, in contrast, was worth nothing and was suspected of taking his life.

By 1933, Jesse had reached a similar fate just four years later.

Both were great at building wealth but terrible at keeping it.

We want to be good at building it and keeping it. So we don’t have to rely on government social programs in our old age.

Warren Buffet’s number 1 investing rule is ‘never lose money; number 2 is refer to number 1.

Getting money and keeping money, as it appears, are two very different skills. Related to this, starting a business and staying in business are two very different skills.

You can’t assume tomorrow will be like today, and therefore what got you here won’t necessarily keep you here.

Anyone who has built a modest, moderate, or significant (bank balance/networth/business – they’re interchangeable here) has done one thing better than anything else.

To quote Nassim Taleb, my favourite grumpy philosopher, “‘Having an edge’ and surviving are two different things. The first requires the second. You need to avoid ruin at all costs.

Patience leads to survival, and greed leads to ruin.