LTV To CAC Ratio: The Golden Marketing Ratio On Every Venture Capitalists Checklist

Did you know you can measure precisely how effective your marketing and sales efforts are with a single number?

Hundreds of unicorn Saas companies have used this metric for decades to guide their marketing efforts while climbing to the billi club.

Even the world’s top venture capitalists say this number is a must-know before signing a check.

It’s called the LTV:CAC ratio.

And just because it was made famous by silicon valley Saas companies doesn’t mean it’s not practical for you and I. Off the top of my head, I can’t think of a single business for which this number won’t improve decision-making.

I use it at my gym. I’ve used it at a hair salon, and we’re about to use it at our Ecom Brand.

This ratio tells you how effective your business is in acquiring new customers. Or in other words, it measures the relationship between the lifetime value and the cost of acquiring that customer.

First, If you don’t know what customer lifetime value is, go here. And if you don’t know what CAC is, read here.

Luckily for us, because startups have used this number for years to drive their businesses, there’s a ton of public data about the optimum ratio.

You’d think the higher, the better, right? Because the higher the ratio is, the more money your business makes per customer. But not quite.

According to everything I’ve read and what my businesses have proven, the sweet spot for this ratio is roughly 3:1.

This means that every dollar you spend on acquiring customers returns your business three. Or the lifetime value of your customers is three times what you’re paying to acquire them.

When the ratio is 1:1, you’re just treading water. And you’re leaving money on the table when the ratio starts pushing above 3x.

Let me explain.

When you’re generating more than 3 dollars for every dollar you spend on acquisition; You’re making a 300% or more return. And there’s probably nowhere else in your business that you can invest and make that sort of return.

So it makes sense to pump as much cash as possible into your acquisition efforts to take advantage of that ROI.

But at some point, your acquisition efforts will experience diminishing returns. Because there are only soo many customers in your target market and the cost to reach those potential customers almost always increases over time. As your LTV:CAC ratio decreases.

Take my gym, for example. We live in a city of 100,000 people, and roughly 10% of those people at any given time go to a gym. So even if I spent a million dollars a year on marketing, I’m probably still only going to bring in a couple of hundred new members a year.

So I’d b spending thousands on each new member, even though they’re only worth a couple of hundred dollars to my business, which is silly.

Every market has its limits, and so your marketing will always suffer from the law of diminishing returns.

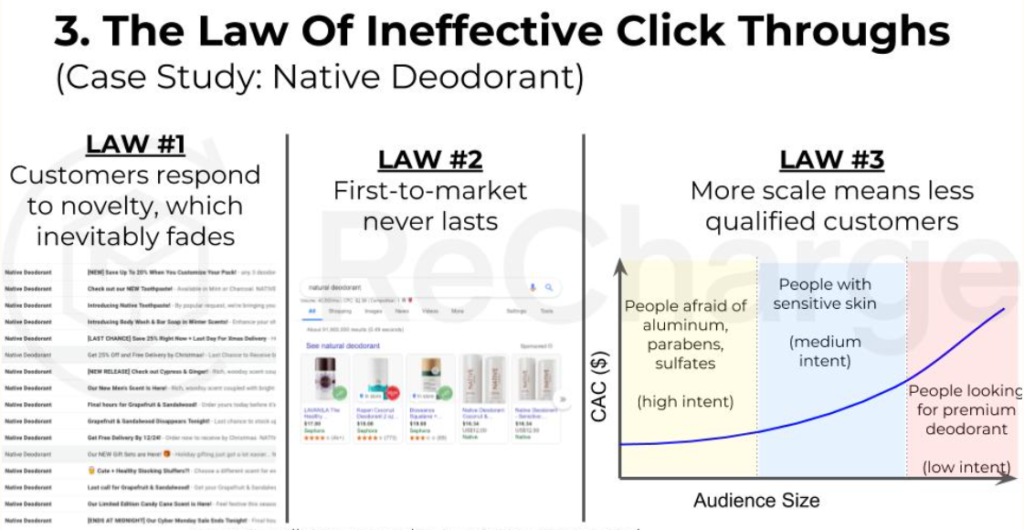

Andrew Chen explained this phenomenon perfectly with his law of shitty clickthroughs framework – illustrated below

Below that magical 3:1 ratio, the same thing happens but for the opposite reasons. When you spend too much on marketing, i.e. you experience diminishing returns and spend well above what’s sustainable for your market.

But sometimes spending isn’t the issue. Sometimes your business’s customer lifetime value is too low, which means you haven’t found something to sell that your market values.

Say the lifetime value of our gym members was only $100. We’d have a big problem because in our market – not a single gym is acquiring members for much less than that. To be effective, we’d need to be able to acquire new members for $33, which isn’t possible in Dunedin.

Business models and industries will vary a bit here. I know eCommerce companies can push for a lower ratio and still do well. At the same time, physical businesses with lots of infrastructure and fixed costs need to sit above 3:1.

As you start tracking this ratio and see how changes in it reflect on your profit and loss statement, you’ll get a good idea of where the sweet spot is for your business.

This incredibly useful ratio has been hiding in plain sight for decades. And it’s about time we start taking advantage of it. It’s not my goto number for assessing my companies marketing effectiveness, and now it can be yours.