A Proven Method To Cut Business Costs

Cutting costs is the simplest and fastest way to increase your business’s bottom line.

In New Zealand (and I suspect these numbers are similar elsewhere), small businesses, on average, grow revenue and presumably profits at ~5% per year. I bet almost any business could achieve this in a month by cutting costs.

Why spend a whole year trying to achieve what simple cost-reducing measures can achieve in 30 days. Don’t you think that’s a little bizarre?

Business expenses continually creep up, often so slowly and methodically you won’t even notice. That’s why ‘fat-trimming’ exercises are soo useful. They often unlock hidden profits.

So forget revenue for a minute if you want to boost profits right now. Start with the expense column on your profit n loss statement.

Here’s what I regularly do to boost profits (often by more than 5%) in just a few days.

First of all, complicated maths isn’t required. Secondly, you can always ask your accountant for help if you get stuck.

1. Log into your accounting program (I use Xero).

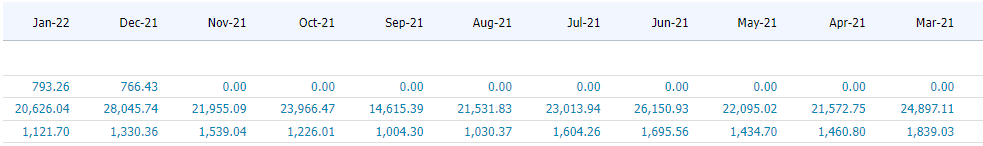

2. Create a profit and loss report, and set the period to monthly and compare to the previous 12 months. You should see numbers like below.

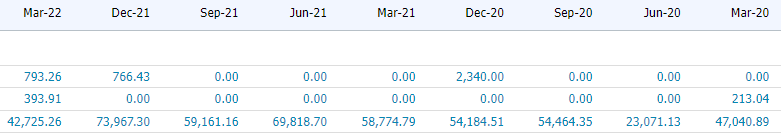

3. Create a second profit and loss report, and set the period to quarterly and compare to the previous 3 years. You should see numbers like below.

4. Assess each expense or line item on your statements compared to previous periods and as a percentage of revenue.

You want to look for a month to month and quarterly increases. Not down the expenses that have increased by more than a marginal amount, say 5%.

Now focus on the costs that have increased as a percentage of revenue first. For each expense that has increased in dollar terms, calculate whether it has grown as a percentage of revenue.

• To calculate the expense as a percentage of revenue. Divide the expense amount by the total revenue amount for the corresponding period.

For example. Below are my month-to-month’ Tribe coaching’ costs at my gym.

We spent $2,400 on tribe coaching just seven months ago, and now we spend close to $5,000 a month. And as a percentage of revenue, tribe coaching has increased from 10% to ~17% of revenue.

This means our increased investment in tribe coaching hasn’t generated a proportional increase in revenue. Which indicates it may be an unnecessary cost or an ineffective investment.

5. Before addressing each cost individually. Create a list of all your expenses that have increased as a percentage of revenue.

6. Now, ask yourself these questions about each expense on your list.

A) Is this cost necessary & does it contribute value to my business?

If it isn’t necessary and not contributing value, then cut it.

I once made the mistake of cutting costs that add business value. A few years back, I reduced the amount we paid our group fitness instructors at the gym, and a few of them left, followed by many members who liked them.

We saved ~$1,000 a month and lost $3,500 in revenue. A bad decision!

In general, don’t cut costs that reduce the value you provide your customers. Or, in my case, costs that piss your staff off.

If the cost is necessary, what can you do to reduce it?

Instead of reducing the rates, I paid our group fitness instructors. I should have reduced the number of sessions on our timetable. We had a few that virtually no one was attending.

Look for cheaper products or service providers that still do the same job.

Reduce your purchase frequency for that product or service.

Negotiating discounts/cheaper rates is another easy win. You’ll be surprised how many providers will agree to a discount. You won’t know if you don’t ask.

7. After working through your expenses that have increased as a percentage of revenue, repeat the exercise for costs that have increased in dollar terms.

As you can see, it’s not rocket science and only takes a few hours to complete while potentially saving you thousands of dollars annually.

I run through this process every 6’ish months and always see a profit boost afterwards.